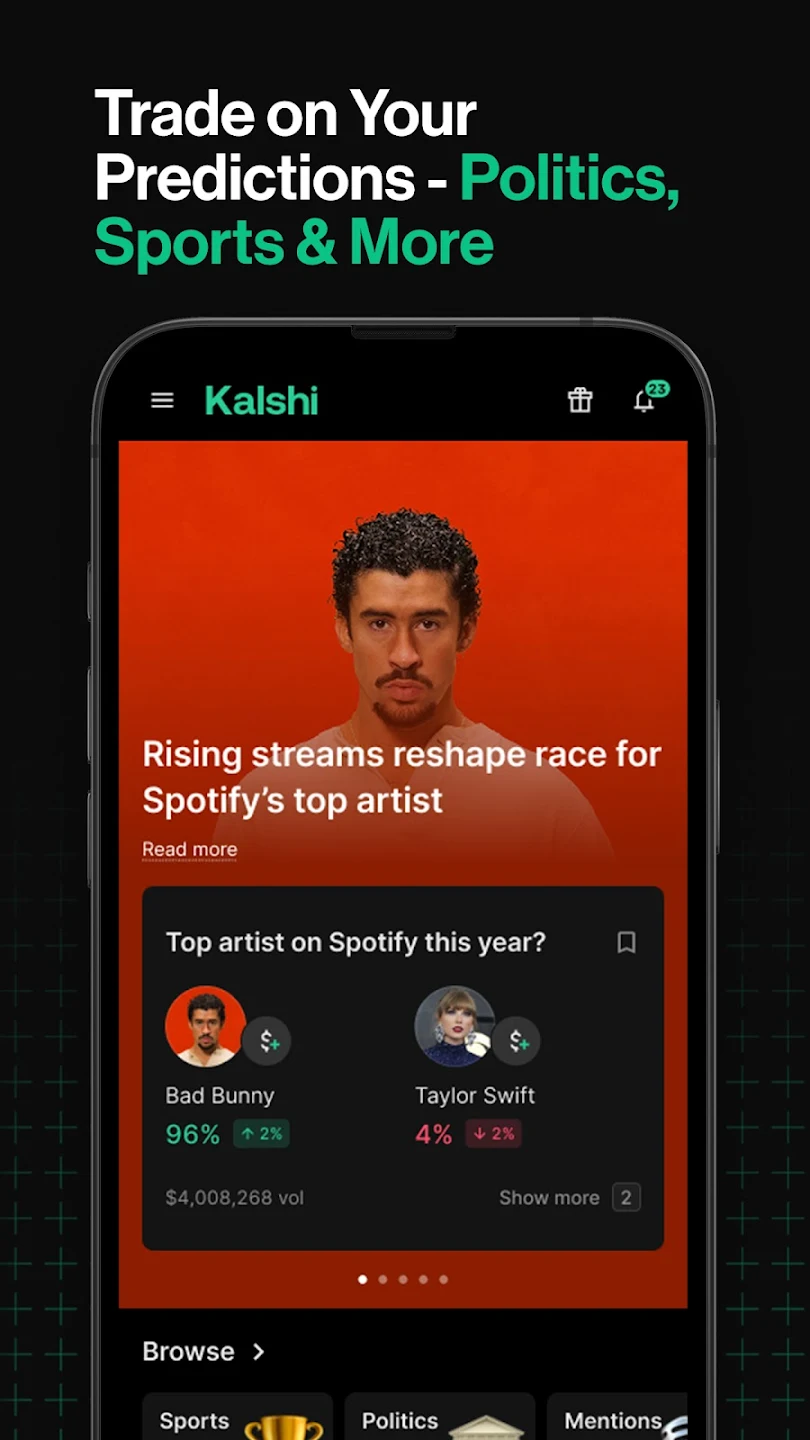

Kalshi 101: How the App Works — and How to Really Make Money From It

- Dec 2, 2025

- 3 min read

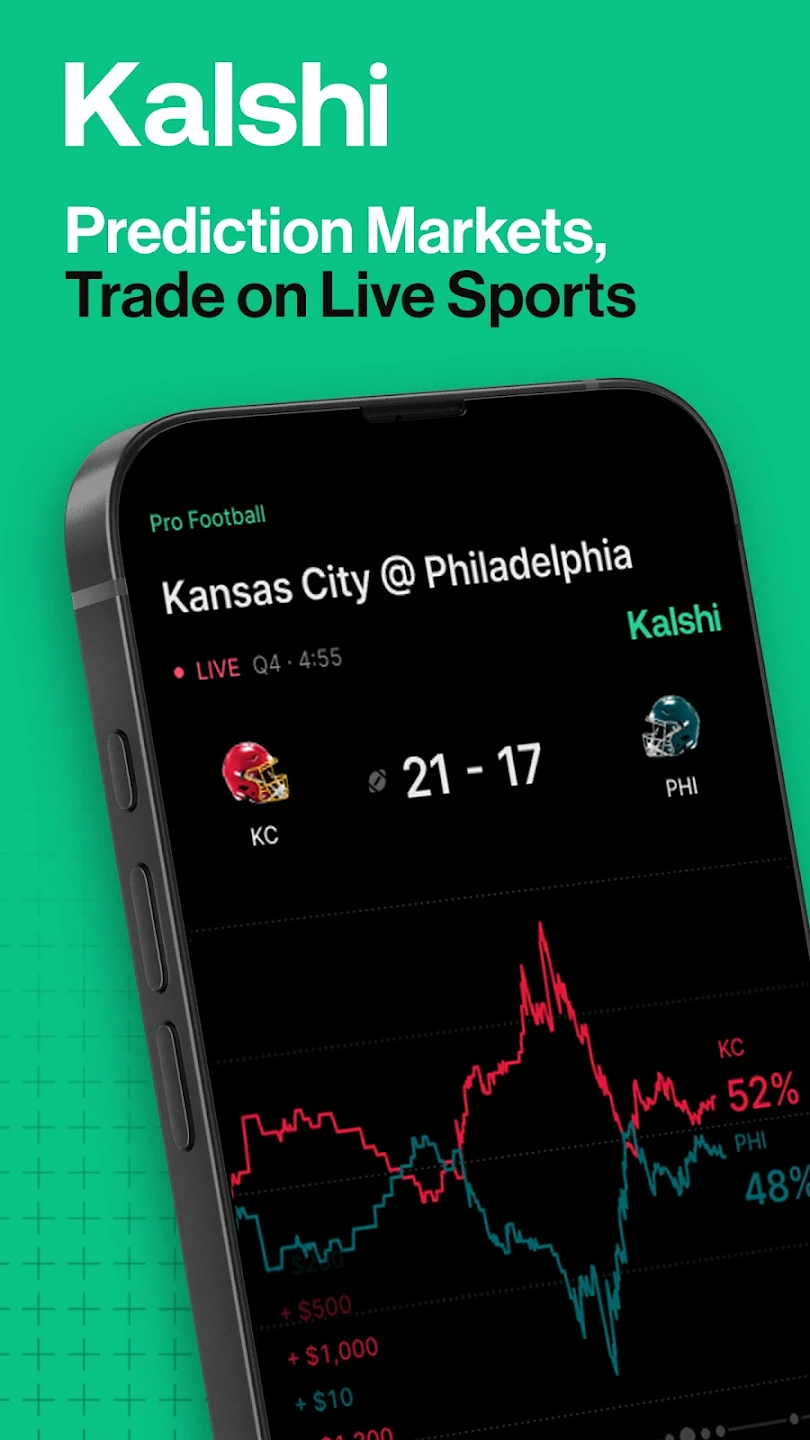

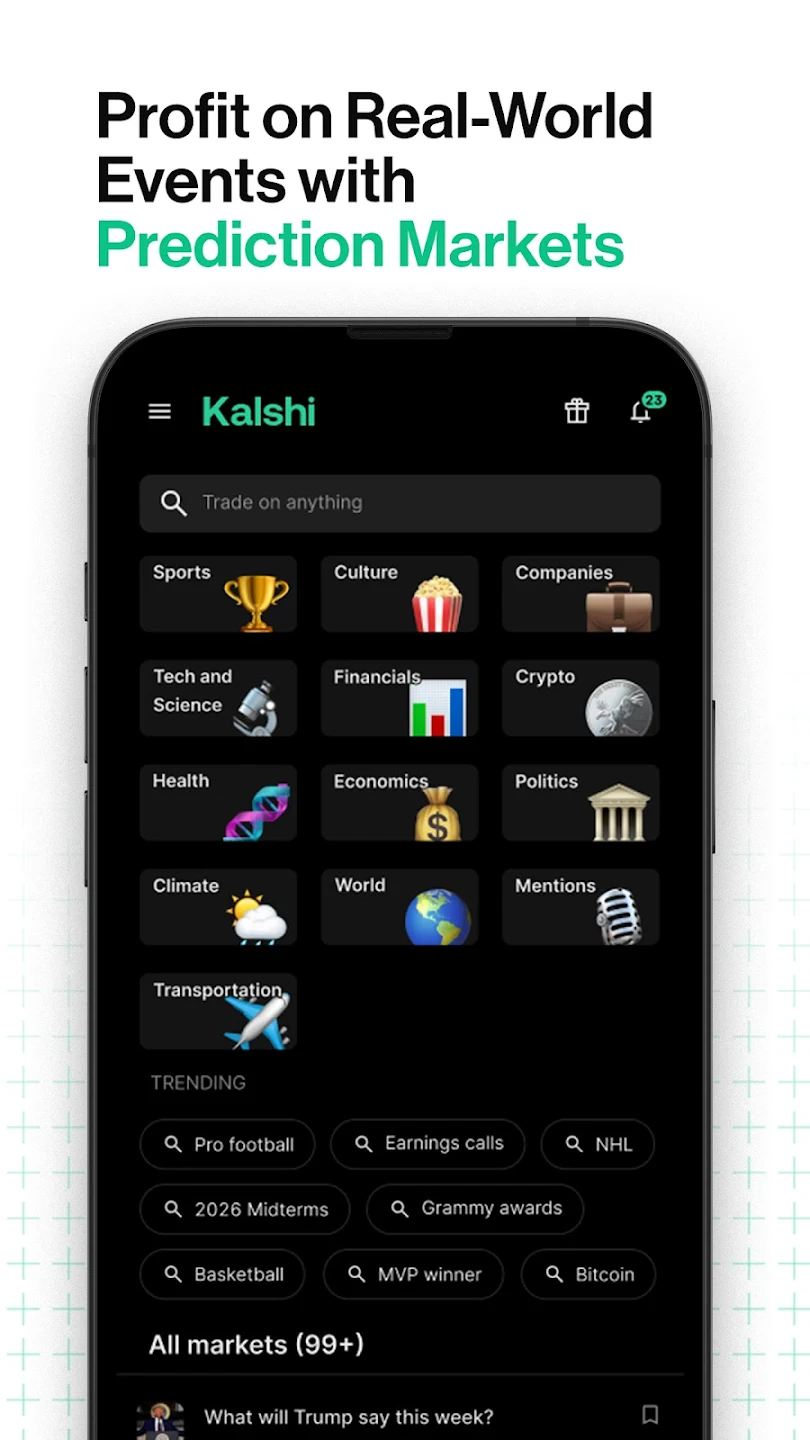

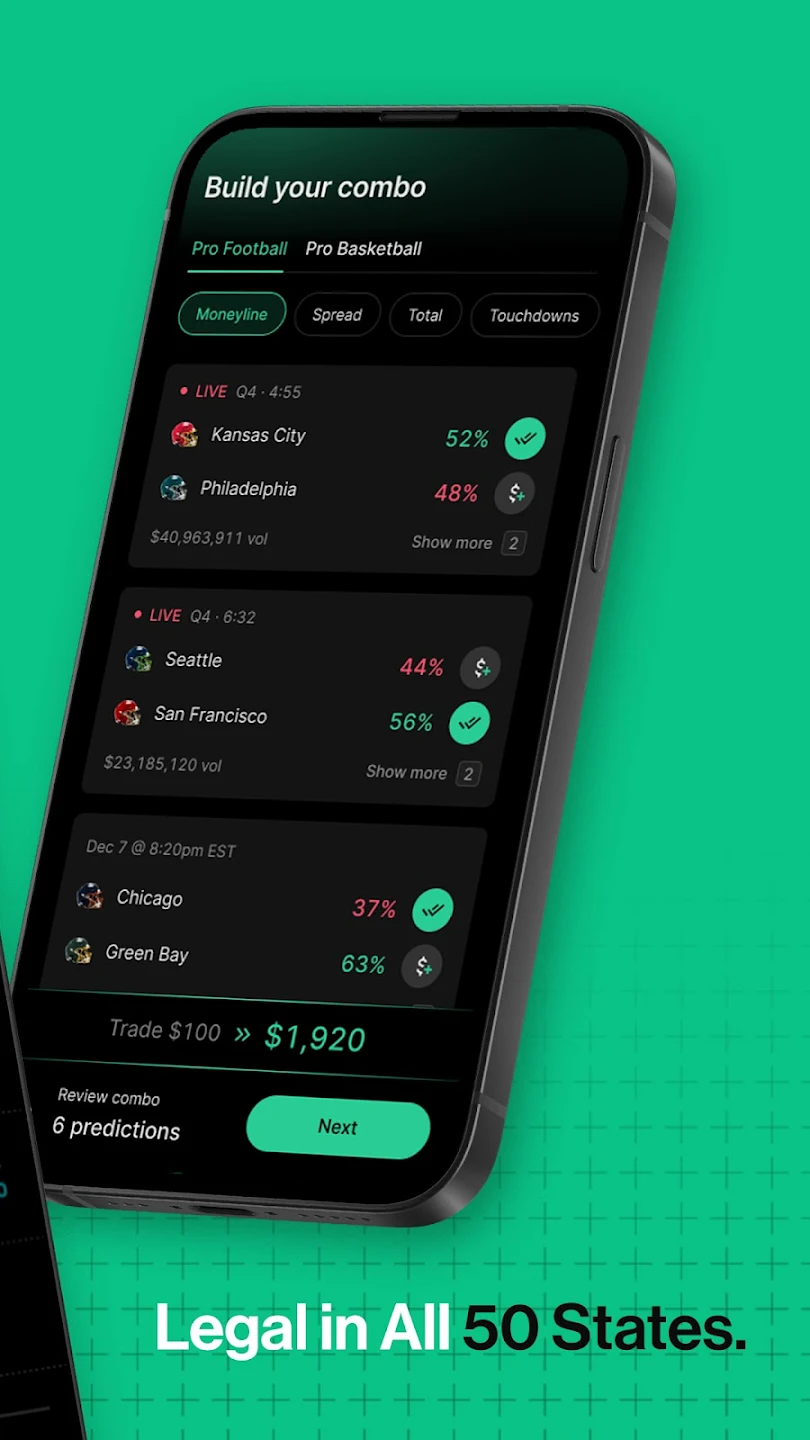

Kalshi is a U.S.-regulated prediction-market app where you trade yes/no event contracts that settle at $1. This post explains how Kalshi works, realistic trading strategies (with a worked example and fee math), the current legal risks, and concrete ways creators can build revenue around Kalshi coverage. Kalshi+1

Why this matters now

Kalshi turned heads by building a federally regulated exchange for binary event contracts. That makes it both interesting to traders and attractive to creators who can explain or package its markets for an audience. At the same time, Kalshi’s push into sports and other categories has sparked high-profile legal fights — making today a moment of both opportunity and caution. CFTC+1

The simple mechanics (the “what” and “how”)

What you trade: Kalshi lists binary event contracts (yes/no questions). Each YES (or NO) contract costs between $0.01 and $0.99 and pays $1 if the chosen outcome happens on settlement; otherwise it pays $0. The market price is the market’s implied probability (e.g., $0.42 ≈ 42%). Kalshi

How you trade: place buy/sell (market or limit) orders; some markets are liquid, some are thin — spreads and slippage matter. Kalshi charges transaction and account fees (deposit/withdrawal fees apply), so every trade should account for fees. Kalshi Help Center

Regulation: Kalshi received designation as a CFTC Designated Contract Market (DCM), which is why the platform exists in the U.S. regulated space — but that federal designation has not ended legal fights about state gambling authority over certain contract types (notably sports). CFTC+1

Realistic direct trading strategies

(for actual human traders)

Specialize in one domain. Your edge is knowledge. Politics, niche tech milestones, or very specific industry events are easier to model than broad sports markets.

Translate price → probability, then compare to your model. If your independent estimate of an event’s chance is meaningfully higher than the market’s implied probability, that’s a candidate trade. Start small to validate your edge. Kalshi Help Center

Respect liquidity & spreads. Thinly traded markets can eat your edge via slippage. Use limit orders and watch bid/ask behavior before committing. Kalshi Help Center Position size conservatively. Treat Kalshi as high-volatility: many small bets with tight bankroll rules (e.g., 1–2% of bankroll per trade) beat a few oversized punts. Kalshi Help Center

Hedge correlated events when possible. If related contracts imply impossible combined probabilities, arbitrage or hedging can reduce risk — but this usually needs capital and attention. Kalshi Help Center

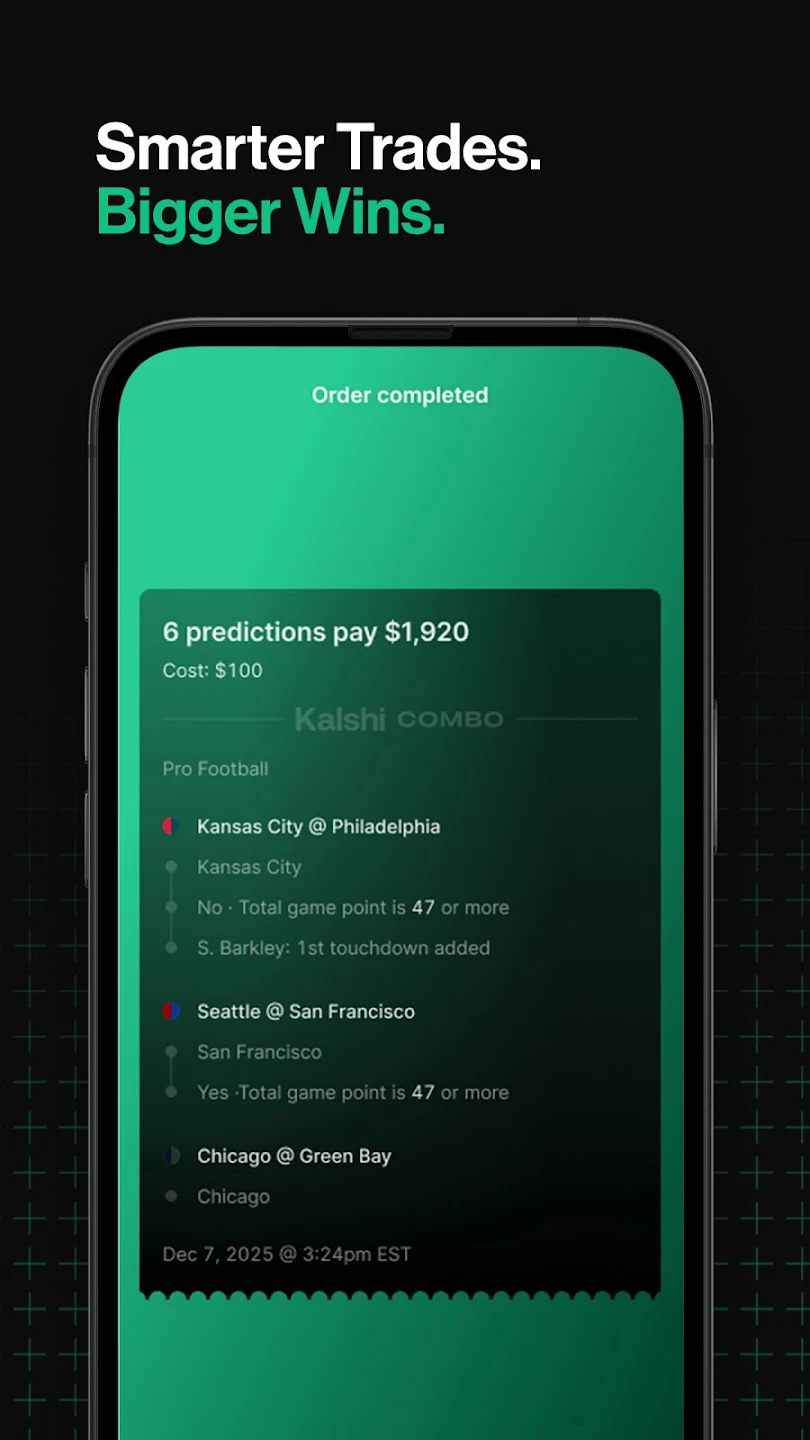

Worked example (numbers people can actually use)

Scenario: You buy 100 YES contracts at $0.54 (market implies 54% chance).

Cost: 100 × $0.54 = $54.00.

If YES: payout = 100 × $1 = $100.00 → gross gain = $46.00.

If NO: loss = $54.00 (your outlay).

Fees note: Kalshi’s public fee schedule lists transaction fees and account deposit/withdrawal charges (e.g., debit deposits have a 2% fee; per-contract trading fees vary by market). For a practical worked example we’ll apply a conservative example trading fee of $1.75 for the 100-contract fill (check the live fee PDF for exact numbers for your market and taker/maker status). Net profit in the winning case ≈ $46 − $1.75 = $44.25, a net ROI of ≈ 82% on the stake. If the contract loses, you lose your stake (and still may pay small execution fees). Always confirm the current fee schedule before trading. Kalshi+1

Short takeaway: the payout math is straightforward; the practical work is (a) finding mispriced probability, (b) sizing trades correctly, and (c) accounting for fees and liquidity.

Legal & regulatory snapshot you must disclose

Kalshi’s regulatory story is active and important for both traders and creators. While Kalshi has a CFTC DCM designation, state regulators and courts have challenged whether particular contracts (especially sports markets) are subject to state gambling laws. A recent Nevada federal decision found Kalshi’s sports contracts fall under Nevada gaming rules — a ruling Kalshi is appealing. These rulings can affect which markets remain available in which states and how regulators treat the activity. Be transparent about this risk in your content and disclaimers. CFTC+1

(Example: media coverage in the last few days has reported the Nevada decision and related class-action filings — keep your legal/“not investment advice” copy up to date.) Front Office Sports+1

Final Thoughts:

Kalshi shows how simple payout mechanics and collective forecasting can create genuine trading and creator opportunities. The math is straightforward, but the real work is finding an edge: specialize in topics you actually understand, watch liquidity and spreads, and size positions so a few losing trades don’t wipe you out.

Cheers!